How to Pitch People for a Horse Syndicate

June 2, 2023

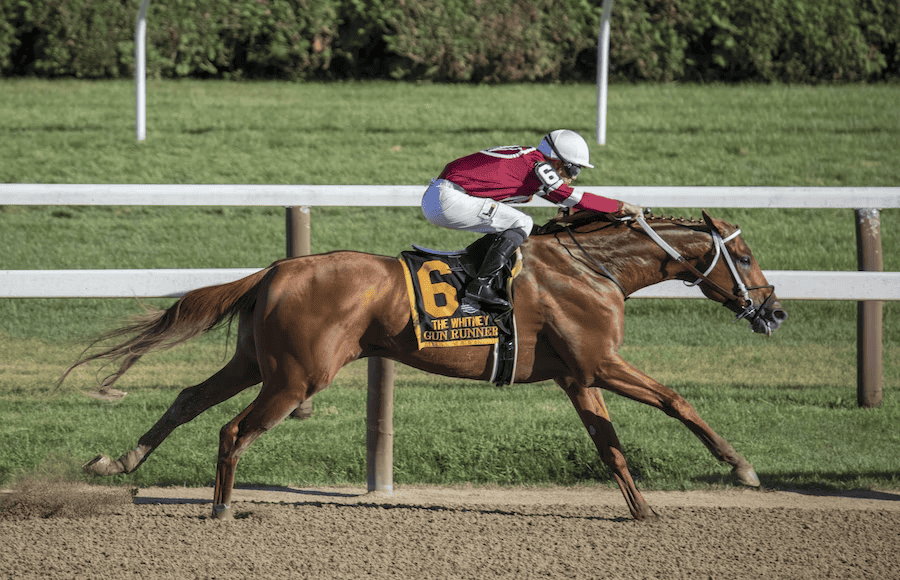

Source: Unsplash

Gambling may be integral to the history of horse racing, but it’s not the only way people profit off of horses.

Horse syndication, otherwise known as a horse syndicate, offers a means for people to invest in and co-own a racehorse – or a competition horse, breeding stallion, or broodmare – to reap the benefits of win, place, or show.

As horse syndicates become more popular, it’s easy to find an option to invest in the next up-and-coming Derby winner or Grand Prix competitor. But if you want to find syndicate members for an opportunity, you have to know how to pitch them right.

First Thing’s First – What Is a Horse Syndicate?

A horse syndicate is a group of people who purchase shares in a horse as an investment with the intention of making a profit on what the horse produces, whether that’s in race purses, competition winnings, or breeding stock.

Syndicates can take many forms, but they all share a common thread of co-owners with fractional interests in the horse and its profits. Because horses are expensive, both to buy and to keep and train, syndication makes ownership more accessible and increases purchasing power.

How to Create a Syndicate

Whether you have a horse that would be suitable for a syndicate or you want to get together with co-owners to purchase one, you have to have your business in order before you can start pitching others to join.

There’s no guarantee that a syndicate will be lucrative for anyone, and partnerships dissolve all the time. Add the volatility of horses as an investment and dealing with large sums of money with practical strangers and it becomes clear why you need to protect yourself.

All said and done, horse syndication is a legal arrangement that goes beyond co-ownership of a horse. It’s a business and should be structured as such.

Source: Unsplash

Form a Business Plan

Your first step should always be forming a business plan. Even if you already own the horse intended for syndication, this plan will outline your expenses for the horse’s care, training, equipment, and insurance, as well as your expectations for how it will generate a profit.

Financial projections are an important part of the equation, as they will clearly outline how your horse will make money, when you can expect these activities to start bringing in income, and how much you expect that will be. This isn’t set in stone, but a well-designed financial report can offer accurate forecasts for the return on investment that will appeal to investors.

Within this plan, include your contingency plans for issues that may come up, including injuries for competition or racehorses, fertility issues in breeding stallions or broodmares, or market shifts that affect the equine industry.

Start a Limited Liability Company

A limited liability company (LLC) is a business structure that keeps your personal assets and liabilities separate from your business assets and liabilities. In this case, that’s your horse and the risks associated with it.

With an LLC, if your business goes bankrupt or receives a lawsuit, your personal assets, such as your home or vehicle, are kept out of the equation. It’s best to consult with an equine attorney familiar with horse businesses and horse syndication to ensure that you’re ding everything correctly.

Draft a Syndicate Agreement

A syndicate agreement, also known as the Operating Agreement, is a document for you, your horse, and your owners that contains information about the benefits and terms of the syndicate.

An equine attorney is an asset in forming an Operating Agreement, but these generally include:

- The purpose for the syndicate (racing, breeding, etc.)

- The rights and obligations of the syndicate participants

- The term of the agreement

- The number of membership participants

- The description of the horse, including details about its foal date, sex, sire, dam, color, markings, registration information, and identifiers like tattoos or brands

- Details of the horse’s performance

- Name of the stable and trainer

- Details of the participants’ entitlements

- Name of the manager

- Details of proposed ongoing expenses

- Details of the inherent financial risk in syndication

- Equine insurance information

- Veterinary certificate

- Breeding rights, if applicable

This document should also include information about who is responsible for decisions related to the horse’s health, training, or wellbeing and the policy for termination for any syndicate member.

Set the Ownership Interest Purchase Price

As the owner of the business, it’s up to you to outline your startup and operating expenses. This may include the cost of the horse, paying for care, training, and travel, entry fees, taxes, registration, and other costs incurred in operating a business.

Once you have a clear picture of your expenses, you can calculate the total cost to determine how many prospective co-owners you need and how much they should pay for fractional interest.

Another expense for all syndicate members is the annual maintenance fee, which is split between the parties and put into an account to cover the horse’s expenses. This is separate from the ownership interest purchase payment, but it’s important to make it clear to any investors.

How to Pitch Prospective Syndicate Members

This is where all your hard work pays off! Here’s how you can go about pitching prospective investors for your horse syndicate:

Source: Unsplash

Find Investors

Some syndicates are comprised of friends or acquaintances who choose to go into ownership together, but not always. Often, you can find potential investors through word of mouth, so be sure to discuss your plans with trainers, farriers, and other owners to spread the word.

Another option is to advertise on online marketplaces and auction sites, which allow investors to stake ownership. If you have a website, you can include a page for horse syndication to attract investors searching for opportunities online.

Plan Your Elevator Pitch

Pitching can be anxiety inducing, especially if you’ve never done it before. It’s important to practice and prepare an elevator pitch, which is a summary of your pitch that you can deliver in 30 seconds.

Your elevator pitch should include your goal for syndication and what makes your offer appealing, such as your horse’s positive performance record, its stellar bloodlines, or the trainer you have involved in the project.

Come Up with a Story

Investors have opportunities to get involved in syndicates any number of ways. What makes yours different? Develop your unique, compelling story about why they should join your syndicate, not anyone else’s.

Source: Unsplash

Discuss the Numbers

All of your prospective investors will want to know what they’re expected to contribute and what they can expect to get in return for their investment. This is where your financial projections will come in handy.

Provide them with the numbers, including your expenses, the cost for ownership shares, and the projections for the income the horse is expected to bring in. Include details like the annual maintenance fees and event entry costs and how they will be handled.

Discuss the Risks

No business venture is without risk, least of all investing in a horse. Don’t gloss over or minimize any of the risks associated with a syndicate. Be clear about the possibility of the horse sustaining an injury or not performing as expected, as well as your plan to rebound from any disruptions.

Talk Up Your Professionals

With all of that out of the way, you can take some time to build hype around the professionals involved in your team and the possibilities. Discuss the credentials and expertise of the trainer or manager involved, sing the praises of the horse’s current track record or bloodlines, and mention any exciting upcoming plans or news.

This is a good opportunity to talk about the ways you’ve prepared for the common pitfalls in horse syndication, such as “problem” managers or managers without experience. Talk about these issues and how you’ve ensured that you have the best person to support your syndicate’s success.

Answer Questions

Investment pitches almost always include some questions. Though you can prepare in advance, it’s inevitable that you will get thrown a curveball. Instead of avoiding the question, making up an answer, or simply saying, “I don’t know,” be honest.

Acknowledge that you’re not sure of the answer, but you’ll do your best to find the answer. Make sure to follow through and get a clear answer that you can give them in the future.

Finish Strong

Once the Q&A session is complete, thank the prospective investor for their time, exchange contact information, and give them a date to make their decision. Be sure to follow up to remind them of the opportunity and the deadline to encourage them to make the leap.

Source: Unsplash

Enjoy the Experience!

Forming a horse syndicate is a fantastic way to help with the costs of horse ownership, generate profit from a winning horse, and enjoy the world of equestrian sports with a fellow group of enthusiasts.

Frequently Asked Questions (FAQs) about Pitching People for a Horse Syndicate

Still have questions? Learn more about horse syndication.

What Financial Documents Do My Syndicate Members Need?

Your Operating Agreement should outline the documents that you have to provide to your syndicate members each quarter or year, such as budgeting reports or company financials. An accountant can help you determine the documents that your owners should receive.

What Happens If the Syndicate Dissolves?

Your Operating Agreement needs to have a clear plan in place for owners who want to sell their share and exit the ownership. Ideally, any exiting member should offer their share to other syndicate members to give them right of first refusal.

If someone outside of the syndicate is interested in buying the horse in total, there should be a voting process in place to make sure that all syndicate members are on board with the sale.

What Are Fractional Racehorse Marketplaces?

Similar to forming a horse syndicate, fractional racehorse marketplaces offer a structure similar to investing in the stock market. There’s no singular body with a group of people investing in a horse, but investors have the option to buy as much or as little ownership as they want to get into the game. These marketplaces even offer micro shares that start at 0.01% for a low barrier to entry.

Leave a Reply

SUBMIT FORM

To inquire into legal services, consulting services, or overnight boarding availability and options, please fill out the form or send a note directly to fairwaystables@gmail.com.

CONTACT US

Follow along on Instagram at @paige.hulse

This website is solely intended for the purpose of attorney advertising, and for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute, in no way establishes an attorney-client relationship. An attorney client relationship is only formed when you have hired me individually and signed an engagement agreement. No past results serve in any way as a guarantee of future results.

Leave a note