Expenses to Prepare for with a Horse Business

May 9, 2023

Source: Unsplash

Horse businesses vary widely, from owning a share of a horse to running a tack shop to operating a boarding facility, all with their own list of expenses.

Part of starting and running any successful business is managing the expenses and revenue to gain a profit. Here are some of the expenses you can expect with a horse business.

Expenses for a Horse Business

The expenses you may have for a horse business depend on the type of business you have. For some businesses, the expenses are similar to other businesses in that category. A tack shop, for example, will have similar expenses for insurance, inventory, employees, and a storefront like any other retail location, whether it’s specific to horses or not.

The same is true of horse businesses that involve services to a horse property, such as landscaping or property maintenance. The fact that it’s a property for horses isn’t likely to generate many additional expenses beyond those for any other property care.

Some equestrian business ventures do have industry-specific expenses, however, such as boarding, owning and leasing a horse to others, owning a share of a horse, or breeding and selling horses.

Some of the expected costs include:

- Hay

- Commercial feed

- Salt or mineral blocks

- Bedding

- Water for the horses

One of the unexpected expenses for horses is veterinary care. Horses need annual exams and vaccinations, deworming, and dental care regularly. Additional services, such as a chiropractor and massage therapist, should also be included in these expenses.

Source: Unsplash

Along with scheduled routine care, you also need to budget for the unexpected. Horses can suffer injuries or illnesses that can be costly, not just in their treatment, but fuel or trailering fees if they need to be transported, accommodation if you need to stay overnight, and follow-up care with medications or supplements.

The utilities for a boarding stable – or as a shared expense for an owned horse – may include:

- Water

- Electricity

- Natural gas

- Fuel

- Business phone service

The facility costs may include:

- Communal tack and barn equipment

- Grooming and first-aid supplies

- The stable and other structures

- Land

- Fencing

- A truck and trailer

- A tractor or manure spreader

If you own the property for your stable, you can determine the costs associated by considering depreciation of your assets.

There are also costs to maintain the facility, such as:

- Barn repair

- Fence repair

- Pasture maintenance

- Machinery or equipment maintenance

- Hired labor

- Manure removal

Finally, there’s insurance costs. Equine businesses need both commercial liability insurance and care, custody, or control (CCC) insurance. These costs can be varied, based on the specifics of your risk exposure.

Source: Unsplash

Boarders are typically responsible for their own equine liability insurance for their horses, and you can require it for your facility. If you’re an owner or part owner of a horse, it’s smart to get equine insurance to protect both you and your horse from risk.

Additional expenses for horse owners may include horse show fees, coaching, trailering, accommodation, and riding clinics.

Keeping an Emergency Fund

Horses aren’t expensive just because of the purchase price but the cost of upkeep. With a horse business, those costs are amplified by unpredictable events.

The best way to protect yourself is with an emergency fund, which gives you a financial cushion for slow business periods, large upfront purchases, low cashflow, or unforeseen circumstances.

Types of Business Expenses

Business expenses are the costs necessary to run your business. You must be aware of the expenses related to your business to develop an accurate budget, track your spending, and determine your budget.

There are three types of business expenses:

Fixed Expenses

These expenses are the same month to month and don’t change based on production or activity. A mortgage or rent payment on your property is a good example, since it stays stable over several years. The changes only come if your escrow is re-evaluated or a lease ends.

With horses, the fixed costs may be the price of land, the stable to house the horses, and fencing. You would need these three things whether you were keeping one horse or multiple, so the fixed costs can be divided among the number of horses.

Periodic Expenses

Periodic expenses are predictable costs that occur a semi-regular basis but vary in costs. They usually aren’t due on the same day like fixed expenses, and may include annual, biannual, or quarterly expenses.

Similarly, expenses that happen on a predictable schedule but rely on a specific event, such as maintenance on your vehicle when it reaches a certain mileage, are considered periodic. Property taxes, annual vet care and vaccinations, and seasonal supplies are also periodic.

Source: Unsplash

Variable Expenses

Variable expenses aren’t as predictable as fixed or periodic expenses. These are typically use-based, such as the cost of feed or fuel. The more you purchase and use, the more you have to pay.

With a boarding facility, the number of horses boarded at the facility affect the costs. Other variable costs for horses include feed, supplements, veterinary care, farrier services, and bedding.

Planning Your Budget

Caring for horses can be expensive. It’s important to create a budget to account for the different costs associated with owning or caring for horses to ensure a profitable business.

You can use a budgeting template or app, but an Excel spreadsheet is often enough to create a budget and track expenses.

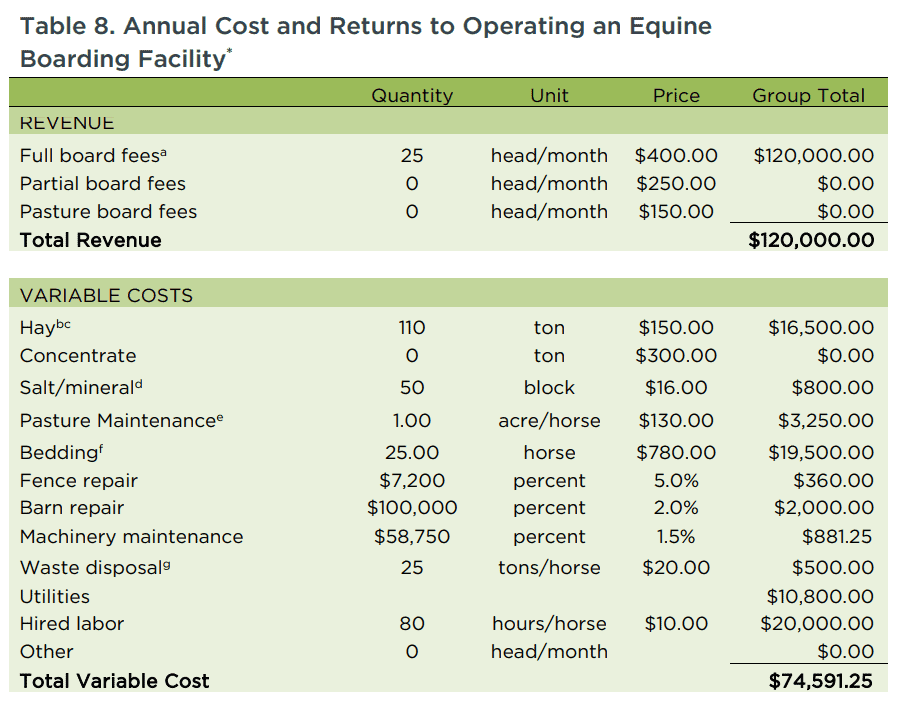

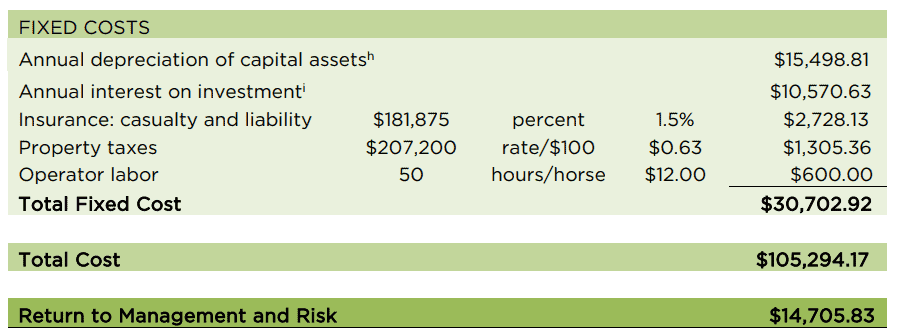

Here’s an example of a horse boarding facility budget from the University of Tennessee:

Sources: University of Tennessee

The budgeting process starts by going backward to look at your past income and expenses. If your business is brand new, you may need to do some research into the typical costs of equine services in your area to create accurate forecasts.

Examine Your Revenue

First, determine all your revenue sources and add them together to get a total that comes into your business each month. Calculate for revenue, not profit – this is all the money that comes in before expenses are deducted.

If possible, calculate your revenue for the past 12 months, if not longer. This will give you a comprehensive view of how your income changes by season or surrounding certain events. Knowing this information helps you prepare for the same pattern in the coming year.

Subtract Your Fixed Expenses

Add up all your fixed costs to see what money you put out. Be sure to include all fixed expenses, such as depreciation of assets, taxes, and debt repayment.

Subtract these expenses from your income and move onto the next step.

Determine Variable Expenses

The variable expenses are important for creating an accurate budget. Some of them may not be necessary for the function of your business, such as improvements to your facility or property. Others are essential to your business, such as your utilities.

Separate your variable expenses into the essential and discretionary. If you have slow periods, reducing your discretionary spending ensures that you can continue operating. Then, when you have more cashflow, you can resume spending to invest in your business.

Consider Your Emergency Fund

As mentioned, large, one-time costs don’t happen at the most convenient times – it’s always when you least expect, and usually when the budget is tight.

Your emergency fund should be part of your budget to ensure you’re putting enough away to build it up. This gives you peace of mind that if your equipment breaks down or you have an unexpected vet bill, you have the funds to cover it.

Create a Profit and Loss Statement

Now that you have all the information about your finances, you can create a profit and loss statement. At this point, it’s just a matter of addition and subtraction.

Add up all your income and all of your expenses for the month, then subtract the expenses from the income. Hopefully, you’ll have a positive number that indicates your profit.

If not, you have a loss. That’s okay – in fact, it’s common with new businesses. Most businesses take a few years to generate a profit.

Create Your Budget

Your profit and loss statement acts as a historical document that tracks the profits and losses for your business. Your budget is a future-focused document that considers the seasonal shifts in your business and the activities that were beneficial or detrimental.

Look for trends like:

- Investments into your business that create a beneficial loss, such as equipment purchases

- Seasonal trends that occur because of economic shifts or inclement weather

- Seasonal trends surrounding travel patterns or holidays

- Unusual profitability that doesn’t have a clear cause

Examining your statement can reveal important trends for your business. For example, you may find that your boarding operation has slow periods during the cold months when many horse owners travel to warmer climates.

Source: Unsplash

You may find that the summer show season has a much higher demand than the rest of the year, creating an opportunity to hire more staff and offer premium services like bathing, grooming, and braiding.

Set Your Horse Business Up for Success with a Solid Budget

You probably got into the horse business because of a passion for horses and not budgets and spreadsheets. But preparing for expenses and budgeting are key factors in the success of your business and your long-term profitability.

Frequently Asked Questions

Still have questions about horse business expenses? Here are some answers to common questions.

What Are the Common Expenses for Owning a Horse?

Though the expenses can vary, the general costs of owning a horse include shelter (boarding), food, water, and veterinary care. Horses also require regular shoeing from a farrier and supplies like grooming tools, tack, and first-aid supplies.

Are Horse Expenses Tax Deductible?

If your horse is necessary to your income or business operations, it’s possible that the horse’s expenses qualify as a tax deduction. You should always consult with a financial professional for business tax deductions and allowable amounts, however.

How Can I Determine My Expenses and Budget?

Preparing for your business expenses and planning a budget is crucial to your business. If you’re not sure how to prepare your budget or what expenses to prepare for with your equine business venture, it’s best to seek guidance from a financial professional or business consultant.

Leave a Reply

SUBMIT FORM

To inquire into legal services, consulting services, or overnight boarding availability and options, please fill out the form or send a note directly to fairwaystables@gmail.com.

CONTACT US

Follow along on Instagram at @paige.hulse

This website is solely intended for the purpose of attorney advertising, and for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute, in no way establishes an attorney-client relationship. An attorney client relationship is only formed when you have hired me individually and signed an engagement agreement. No past results serve in any way as a guarantee of future results.

Leave a note